how to file taxes if you're a nanny

You may owe state unemployment taxes SUI Do not count wages if your nanny is a spouse your child under age 21 or parent. Connect With An Expert For Unlimited Advice.

Nanny Tax Pitfalls And Need To Knows For Your Taxes

Ad Easy To Run Payroll Get Set Up Running in Minutes.

. Year-to-date information should be indicated on your final pay stub of the year. You will use this form to file your. Your employer is required to give you a form W2 by January 31st.

If you pay a nanny or any other caregiver 2400 or more during the course of the calendar year you must withhold taxes from their paychecks and pay your share of taxes. Nanny is paid 2000. Taxes Paid Filed - 100 Guarantee.

Ad Nanny Household Tax and Payroll Service. If youre a nanny who cares for children in your employers home youre likely an employee. Complete year-end tax forms.

Be very sure that 7 A a is the sum of the gross wages plus the values for Social Security and Medicare Taxes due from the employer. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. If so you are a household employee and the employer should be.

Since you dont pay nanny taxes including unemployment taxes you can expect a call from your state with failure-to-pay and failure-to-file penalties which can add up to 50 percent of the tax. However youll still need to pay this tax on wages. CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

Ad Dont Know How To Start Filing Your Taxes. Did you earn over 2100 in 2019. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return.

Form W-4 is provided to your nanny so you can withhold the correct amount of federal income tax from. Apply for one online. Ad Easy To Run Payroll Get Set Up Running in Minutes.

You as an employer just enter the hours and everything gets calculated for you but it doesnt make payments on your behalf or file tax returns. You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the child care tax credit. I am a nanny how do I pay my taxes.

Revealing and Filing Taxes. In addition to income taxes you. Taxes Paid Filed - 100 Guarantee.

Attach Form 4852 Substitute for Form W-2 Wage and Tax Statement to your return. This form will show your wages and any taxes withheld. We need more information.

Some other services can even. Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online. Prepare and distribute Form W-2 to your employees by January 31 for the previous years taxes and wages.

Your nanny should fill out an I-9 a federal W-4 form PDF and a state withholding form if your state collects income tax. Nanny Tax Example. To file quarterly utilize this structure to estimate representative federal annual tax manager and.

File Copy A of Form W-2 and Form W-3 with the Social Security Administration by. Attach Schedule C or C-E. Do you work as a nanny in the employers home.

Ad Nanny Household Tax and Payroll Service. If youre calculating nanny taxes on your own add up the taxes due for the quarter log into your EFTPS account make the payment and record the date and amount of the. The bottom line of Schedule C on line 31 Net profit or loss will then flow to line 12 of Form 1040 Business income or loss.

However its not the reason you went into business. Forms when hiring a nanny or household employee. Pay Your Nannys Salary.

That means you file taxes the same way as any other employed person.

Caregivers Here S How Taxes And Payroll Work Care Com Homepay Nanny Tax Nanny Nanny Interview Questions

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

Pdf Doc Free Premium Templates Receipt Template Daycare Forms Free Receipt Template

Nannies What Are Your Legal Responsibilities When Employing A Live Out Nanny Babycenter Canada

Babysitting Tax In Canada What You Need To Know

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

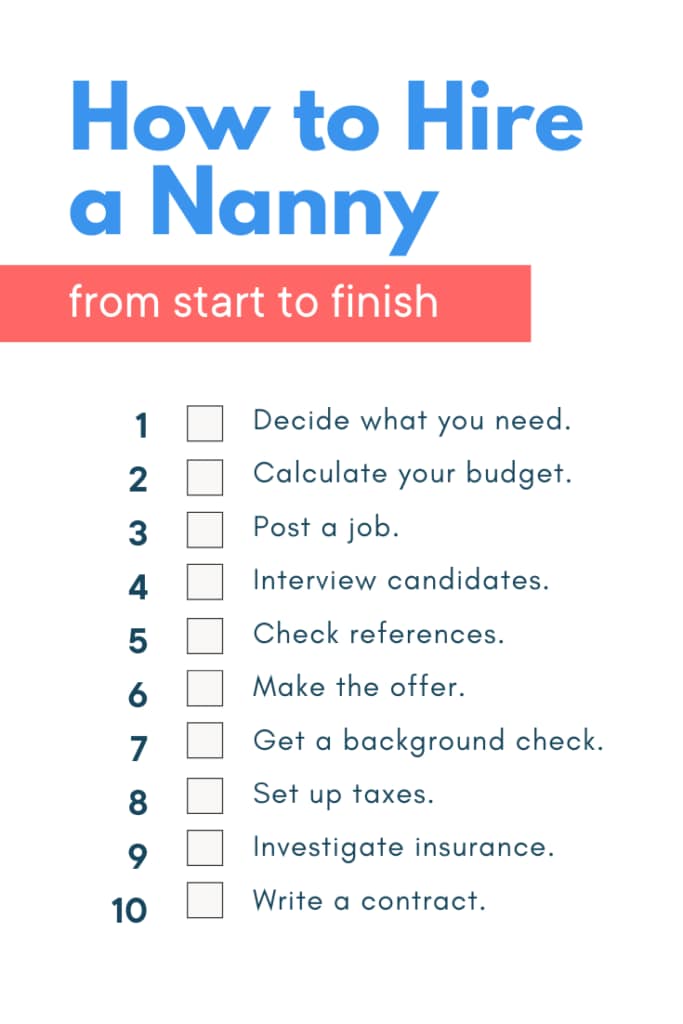

Here S How To Hire A Nanny From Start To Finish Care Com Resources

Nannies Can Be More Affordable Than Daycare But Beware Tax Legal Implications Canadian Business

How Does A Nanny File Taxes As An Independent Contractor

The Differences Between A Nanny And A Babysitter

Child Care Expenses The Ins And Outs Of Hiring A Nanny

Free Daycare Forms And Sample Documents Daycare Forms Starting A Daycare Family Rules

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

The Tax Implications Of Having A Nanny Or Housekeeper The Turbotax Blog

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax Nanny

7 Steps For Filing Taxes As A Nanny Or Caregiver Care Com Homepay